Savings Account

Secure and FDIC-insured, but with modest returns.

Services

Accelerate Your Growth with Strategic Capital Investments

Growth capital investments lay the foundation for future financial success. Our tailored approach helps businesses manage their capital effectively, balancing immediate needs with long-term goals.

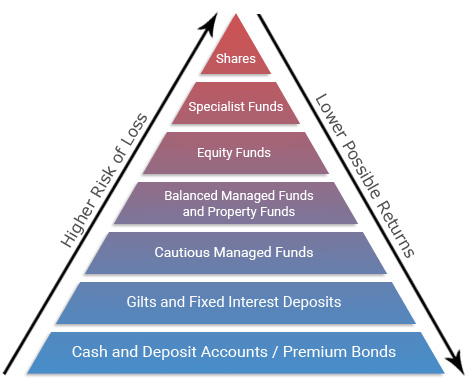

A robust financial strategy involves a well-considered mix of investments. At the base of our strategy are cash alternatives, which provide low risk but also yield lower returns. As you move up our investment pyramid, potential returns increase along with the associated risks.

Cash alternatives form the cornerstone of a balanced portfolio, offering liquidity to cover short-term and unforeseen expenses. This flexibility allows you to manage other investments more effectively, avoiding hasty decisions during market fluctuations.

Note: Asset allocation is a strategy to manage investment risk, not to eliminate it.

To ensure liquidity, consider these options, each with its pros and cons:

Secure and FDIC-insured, but with modest returns.

Time deposits with slightly higher returns than savings accounts, often requiring larger deposits.

Investment funds aiming to maintain a stable value, though not FDIC-insured and carrying some risk of loss.

Government-backed debt instruments offering reliable returns.

At various stages of your business journey, it's essential to maintain sufficient capital reserves to cover expenses in three key areas:

Have enough capital to sustain operations during revenue shortfalls, typically covering three to six months.

Set aside funds for unexpected events, such as economic downturns or significant operational disruptions.

Reserve capital for upcoming significant expenses, such as expansions or major investments.

Effective money management is the cornerstone of financial success. We are here to help you navigate your financial journey with strategic growth capital investments.

Need expert advice on your capital investment strategy?

Request your complimentary first appointment today.